We advise buyer clients and mortgage providers on financing and refinancing

We can advise buyer clients and their mortgage providers or bridging lenders in matters relating to using commercial property as security for the loan. A typical transaction may involve working through a mortgage provider’s terms and requirements and ensuring that the property represents adequate security for the loan.

We can act for new lenders in refinance matters, typically in scenarios where a client is replacing one lender with another.

Often, finance and refinance matters are time sensitive matters.

Here at HSR Law we have a dedicated team of professionals who understand the urgency of matters and can assist clients with each step of the process.

We have strong, proven experience in handling large and complex property acquisitions. For more details on how we can support you or your business, contact our Commercial Property team today.

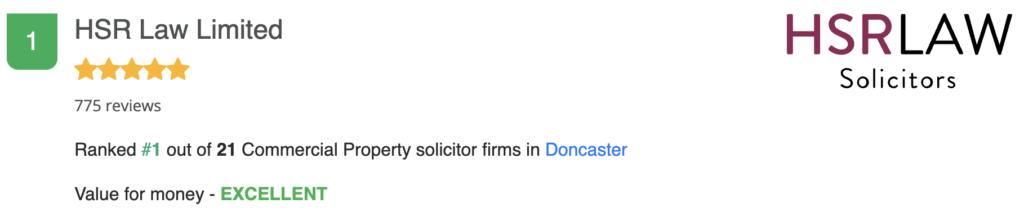

Our Commercial Property Solicitors rank #1 in Doncaster on ReviewSolicitors

Your Financing and Refinancing Team

Commercial Property FAQs

Although most tenants enter renewal negotiations towards the end of the lease term, there is no restriction on the parties discussing an extension at any time during the lease.

For example, if a tenant has a five-year lease and the business is thriving at that location, they may know after only a year or two that they wish to make the arrangement a longer term one.

Once agreement has been reached by the parties, the terms will need to be properly documented. Our commercial property experts would be able to assist you with documenting the extension. One of the ways we would do this is with what’s called a reversionary lease. This is essentially a lease in broadly the same form as the current lease, but which does not start until the current lease comes to an end. It’s important that the parties take specialist advice as there can be important points to discuss in such a lease. There can also be Stamp Duty Land Tax implications for the tenant.

If a tenant’s lease is close to its expiry term, then there are implications at renewal time depending on whether the lease benefits from security of tenure (and is what is sometimes called a “protected business tenancy” or a lease that is “inside the Act” – the act in question being the Landlord and Tenant Act 1954) or whether the lease is “outside of the Act” or which does not have protection under the security of tenure provisions of the Act.

Protected leases give tenants more legal rights to request a renewal from their landlord. Where a lease does not have that protection then at the end of the lease term a tenant has no right to remain the property.

For tenants, it’s really important to understand what sort of lease they have before renewal discussions take place (of course, it’s really important to know these implications before the lease is even entered into).

Either way, we can help landlords and tenants plot a strategy for lease renewals.

In short, the answer is “possibly”.

Landlords may be familiar with the term “forfeiture” of a lease. Forfeiture is the legal term for ending the lease and re-entering the property.

It is important before taking any action against a non-paying tenant to review your lease. A properly prepared lease should reserve you a right to ‘forfeit’ the lease if the tenant is in breach of any of its obligations under the lease.

Forfeiting a tenancy can be incredibly complicated and can involve taking Court proceedings. If you are owed rent, or if your tenant is in breach of the lease obligations, you should seek immediate legal advice. Ratifying or allowing a breach to continue can make forfeiture down the line more difficult. If, for example, you have allowed a tenant to breach repairing obligations and you know about it, but have done nothing about it for a while and carried on collecting rent from the tenant, then your tenant might be able to raise this fact as a defence to any later forfeiture proceedings.

You will also need to be aware that tenants can apply to Court or relief against forfeiture. That is to say they can ask a Court to restore their lease. Importantly for you, a tenant can claim relief from forfeiture after the date of possession (as ordered by the Court) or the date of re-entry (if ‘forfeited’ by peaceful re-entry). You will need to take great care when reletting a property that has had the lease forfeited and take appropriate advice.

“Assigning” your lease is the legal term for transferring or selling it to someone else. Perhaps business has not gone well, and someone else can make a better go of things from your location. Or perhaps business is going really well, and someone wants to pay you for your business and wants to carry it on. Either way, the starting point is to review your lease itself.

When you signed your lease, you will have agreed to be bound by certain conditions relating to assignment. In most standard commercial leases, your landlord will not be able to unreasonably refuse to allow you to assign your lease if it has a long time left to run (in some short leases assignment might not be allowed at all). If you are a persistent poor payer of rents, or if you have repeatedly failed to comply with the lease, your landlord might use your poor performance as a reason to refuse your request. Your landlord is entitled to know who the incoming tenant is, whether they can pay the rent and how reliable they might be as a tenant. Armed with that information, the landlord might insist on the incoming tenant paying to them a rent deposit or to the incoming tenant providing a guarantor. The landlord may also ask that you provide a guarantee to the incoming tenant too, under what is called an Authorised Guarantee Agreement.

Whatever the circumstances, it is vital to review your lease before you take any action to assign your lease. If you contact HSR Law, we can review your lease and offer you the advice you need so that you know exactly what you can and cannot do.

“Dilapidations” is the term used to refer to any items disrepair or any breach of the tenant’s covenants in the lease. It is common that a commercial lease will place an obligation on the tenant to ‘keep [the property] in good repair’ or wording of a similar nature, as well as decoration provisions. If the property is returned to the landlord at the end of the term and you have not kept the property in good repair, the landlord may require you to put the property into the required state of repair, or pay an amount to the landlord as their costs for doing so.

The most common terms which a landlord may dispute with you are: the repair covenants, decoration covenants, compliance with laws clause, and any re-instatement requirements (usually applicable if you have carried out any works at the property). If you have carried out works, the landlord usually requires that any works are removed and any damage caused by the removal of those works is made good before the property is returned.

Whilst dilapidations are not usually dealt with until the end of the lease (although they can be dealt with during the lease too), it is always best practice that you consider your obligations under the lease from the outset. Our commercial property experts will advise you on the steps which you can take to limit any liability for dilapidations and highlight any particularly onerous terms within the lease which may increase your liability for dilapidations at the end of the term.

If a company buys a residential property (house/flat) then it pays an additional 3% surcharge on top of the usual residential property rates of SDLT.

Where the purchase price for a residential property is more than £500,000 the company pays a flat rate of 15% of SDLT on the whole purchase price. Our commercial property team will be able to advise you on the estimated SDLT liability for the transaction.

It’s really important for a company to note, too, that where the purchase price for a mixed-use property (that is to say a commercial unit on the ground floor and flat above it) multiple returns may need to made. If the residential unit itself is valued at more than £500,000 the company will remain liable for SDLT at the flat rate of 15% for that aspect of the transaction.

Companies also need to think about the annual taxation on enveloped dwellings (ATED), which in essence is an annual tax payable by companies that own residential property worth more than £500,000 (2016/2017 levels – the value was greater in previous years).

There may be reliefs available from these rates, and circumstances where transactions might be structured in such a way as to mitigate your SDLT liability.

If you contact HSR Law, we can work with you and your advisers to explore all the options available to you.

*Please note these thresholds and rates are accurate as at October 2024.

Our Latest News

- Am I Eligible for the Right to Buy Scheme? Key Rules ExplainedThe Right to Buy scheme helps council tenants purchase their homes at a discount, but not everyone qualifies. In this guide Amy Fields, Partner and Head of Residential Conveyancing explains who can apply, how discounts are calculated, and how our team can support you through the process from start to completion.

- Should I Replace an Enduring Power of Attorney with a Lasting Power of Attorney?If you created an Enduring Power of Attorney (EPA) before October 2007, it remains legally valid and does not need replacing. However, many people now choose to make a Lasting Power of Attorney (LPA) for added flexibility, including health and welfare decisions. Our specialist solicitors can advise on whether an LPA is right for you and guide you through the full creation and registration process.

- Lasting Powers of Attorney Certificate Provider – What you need to knowA Lasting Power of Attorney must include a certificate signed by an independent person confirming the donor understands and agrees freely to the LPA. Choosing the right certificate provider is essential to avoid rejection or delay. HSR Law can guide and act as your certificate provider.

- Graham Bembridge retires after more than 50 years in the Legal ProfessionGraham is taking his well-earned retirement from the firm after 50+ years in the Legal Profession in Gainsborough.

- Protecting your Estate against future care costs – “Can I transfer my property to my children to avoid paying care fees?”A question we often get asked is whether clients are able to gift their assets away to their children to avoid this asset being taken into consideration if they required residential care.

- Share Rights & Classes: What your investment really says about you!If you are dealing with specific situations regarding share classes or rights, it’s often advisable to seek legal advice to ensure the Articles of Association accurately reflect the desired governance structure.